Small businesses often face unique financial challenges, but with the right strategies, they can achieve stability and growth. Understanding cash flow is crucial for any business, and small businesses are no exception. Proper budgeting and forecasting are essential for making informed decisions. Effective financial planning can help small businesses navigate economic fluctuations and maintain profitability. Building strong financial relationships with banks and other financial institutions is vital for securing loans and credit lines. This can help businesses expand and invest in growth opportunities. Developing a robust financial management system is essential for tracking income and expenses accurately. This allows for better decision-making and helps identify areas for improvement. Regular financial reviews are critical for identifying potential problems early on. This proactive approach allows for timely adjustments and prevents financial crises. Seeking professional advice from financial consultants can provide valuable insights and guidance. By implementing these strategies, small businesses can build a strong financial foundation and achieve long-term success.

Boosting Profitability: Strategic Treasury Solutions for Corporations

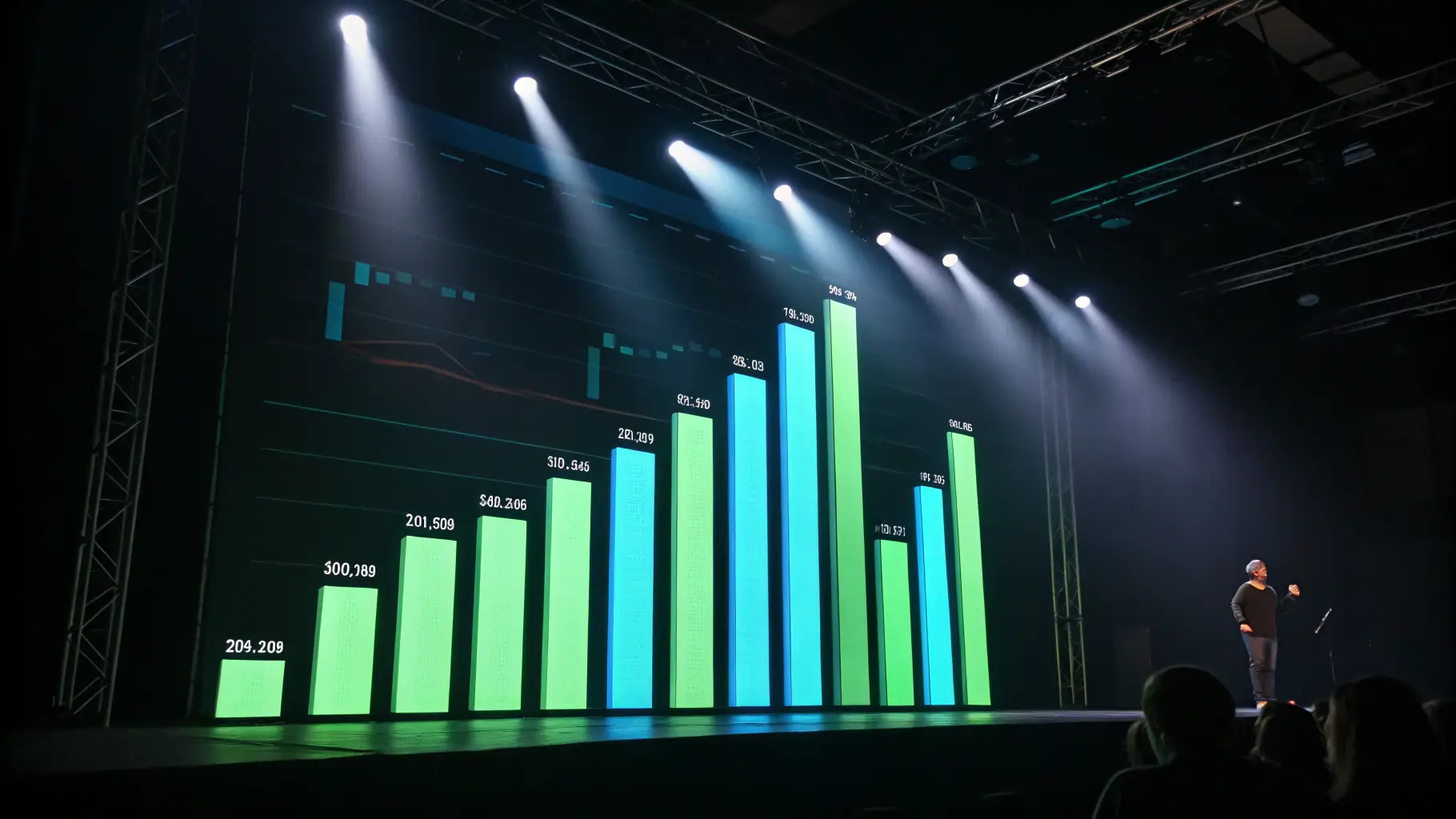

A large corporation leveraged Finalysis’s strategic treasury solutions to optimize its financial performance and achieve