The Finalysis Approach

At Finalysis, we focus on capturing and managing your true net position.

-

We start by assessing your overall aggregate and net corporate positions, then ensure liquidity and currency are managed at the lowest cost and risk.

-

We review reports, banking structures, borrowings, rates, maturities, currency policies, hedging, investments, transaction costs, and bank charges for efficiency and transparency.

-

We take a “helicopter view” of your business domestic and foreign to ensure all activity is captured, monitored daily, and benchmarked against costs.

-

We maximise natural offsets by consolidating local or isolated treasury activities to leverage scale.

-

In almost every review, we uncover significant cost and efficiency gains.

-

We can deliver savings of €20,000 for every €10 million turnover, repeating fully in later years.

-

We operate on a no benefit no fee policy, ensuring that no cost will be incurred if no benefit is achieved.

Finalysis Academic Team

Our team brings deep expertise in treasury and banking consulting.

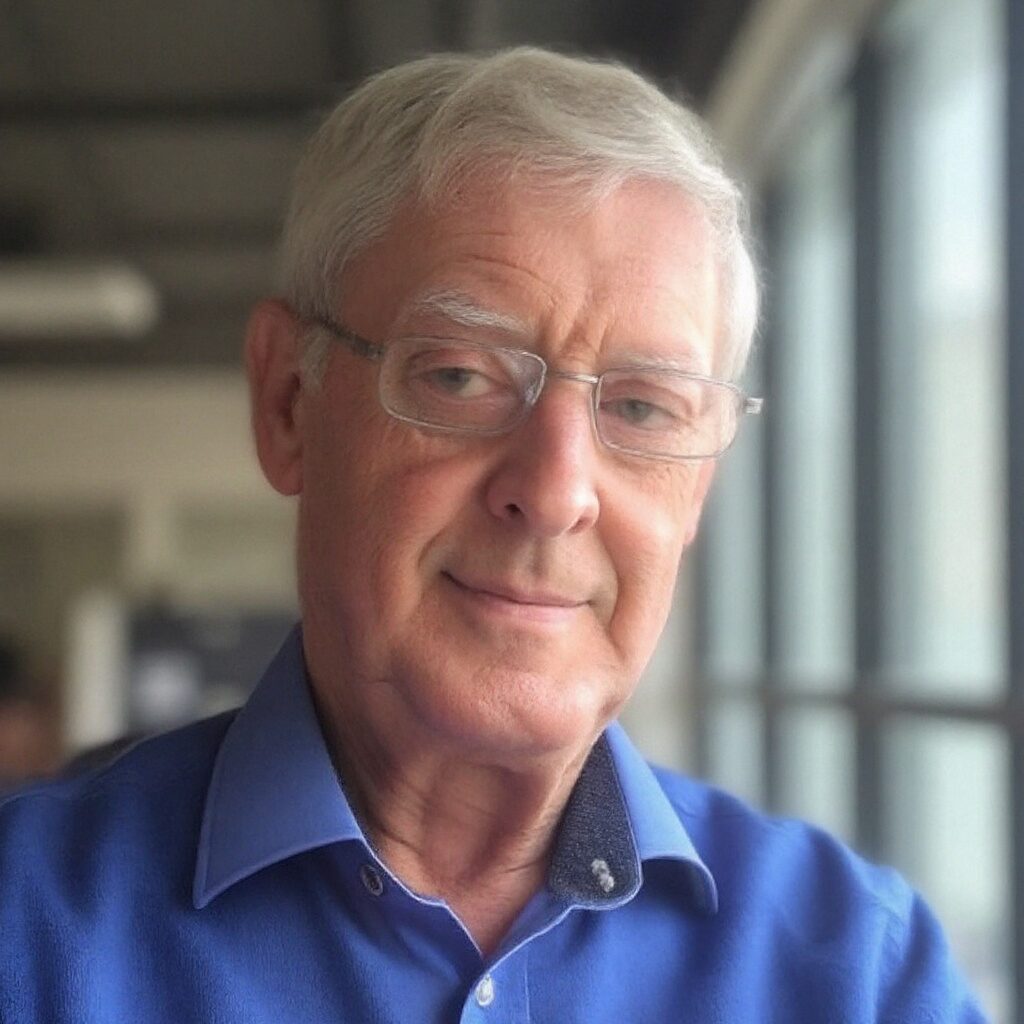

Dr. Patrick Shallow

Chief Executive Officer

Dr Patrick Shallow is a senior banking adviser, economist and credit risk specialist with more than thirty years of experience in corporate finance, structured banking and regulatory analytics. He holds a PhD in Credit Risk Analytics, an MSc in European Economics and a BComm in Law and Economics.

A Fellow of the Institute of Bankers, Patrick has advised boards, financial institutions and government bodies on funding strategy, risk management and long-term financial planning. His insight and independence allow him to guide clients in optimising capital structures, assessing risk and creating sustainable value.

Prof. Brian O'Kelly

Senior Consultant

Professor Brian O’Kelly is Emeritus Professor of Finance at Dublin City University and former Academic Director of its MSc in Investment, Treasury and Banking. He is widely recognised as one of Ireland’s leading authorities on corporate banking and treasury, combining academic expertise with senior industry experience.

He previously served as General Manager of Credit and Financial Risk at Permanent TSB, was a Founder Director of QED Equity and worked in AIB Capital Markets as a corporate banker and risk manager. His expertise spans credit risk, securitisation, derivatives and treasury strategy, bringing depth and credibility to every Finalysis engagement.

Keith O'Leary CFA AFM

Senior Consultant

Keith O’Leary is a Chartered Financial Analyst (CFA) and certified Advanced Financial Modeller (AFM) with international experience across investment banking, corporate banking and risk management. He is skilled in developing sophisticated financial models, carrying out detailed analysis and delivering clear recommendations that support confident decision making.

Known for his integrity and professionalism, Keith has successfully managed complex transactions and guided organisations through challenging financial environments. His mix of technical expertise and commercial focus ensures that clients receive solutions that are both rigorous and practical.