Budgeting is a fundamental aspect of personal finance. It allows individuals and families to track their income and expenses, enabling them to make informed financial decisions. Creating a detailed budget helps individuals understand where their money is going and identify areas for potential savings. This process promotes financial awareness and responsibility. Budgeting helps individuals and families prioritize their financial needs and goals. By allocating funds to essential expenses and savings, they can work towards achieving their financial aspirations. This includes saving for emergencies, retirement, or major purchases. A well-structured budget provides a roadmap for achieving financial security. Regular review and adjustments to the budget are essential for maintaining its effectiveness. Life circumstances change, and budgets need to adapt accordingly. This ensures that the budget remains relevant and effective in helping individuals and families achieve their financial goals. Seeking professional financial advice can provide valuable insights and guidance in developing and maintaining a robust budget.

Boosting Profitability: Strategic Treasury Solutions for Corporations

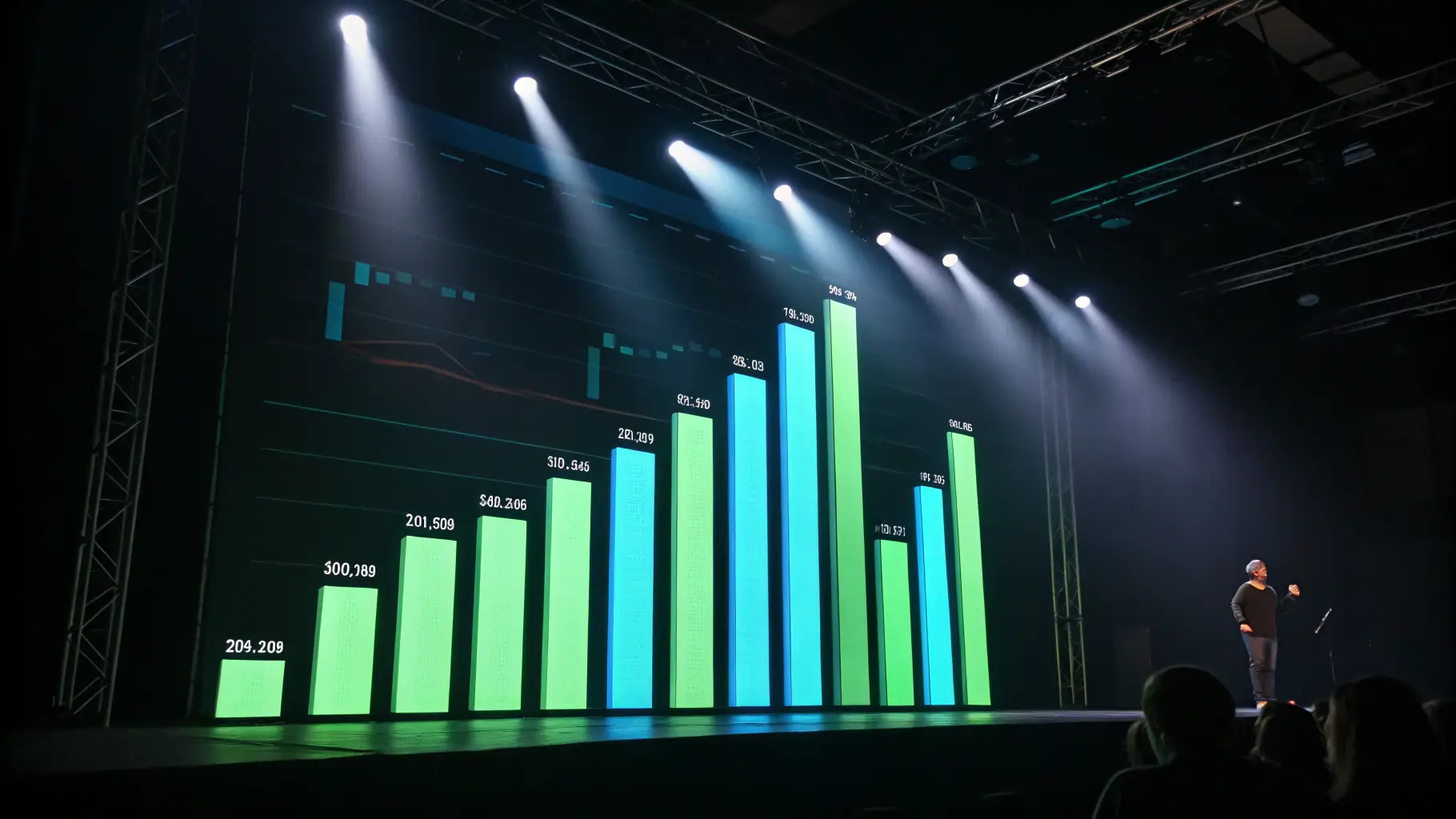

A large corporation leveraged Finalysis’s strategic treasury solutions to optimize its financial performance and achieve